HR Job Market Report: May 2022

Impending elections typically shake business confidence and slow employment, but 2022 has bucked this trend. After a slowish start to the year, we saw the HR job market gallop into March and April unconcerned about the spectre of rising interest rates, global instability and Australian federal elections.

To learn about HR job market trends download the resources below or keep reading for more information.

Nothing slows phenomenal HR job market

Normally a federal election will put the brakes on the HR job market (and most other forms of investment). This time around, the reality of an unemployment rate with a 3 in the front of it and talent shortages in a wide range of categories creates its own dynamic. The strength of the national employment environment as a result of labour shortages is exerting pressure on the HR market.

24-months ago the HR job market dropped off a COVID cliff. Since then, the rise and strength of the HR job market has been phenomenal. We have seen strong demand in all categories and geographies. There are some particular hot spots in the market and these emphasise the challenges that the vast majority of organisations are experiencing to secure and attract talent.

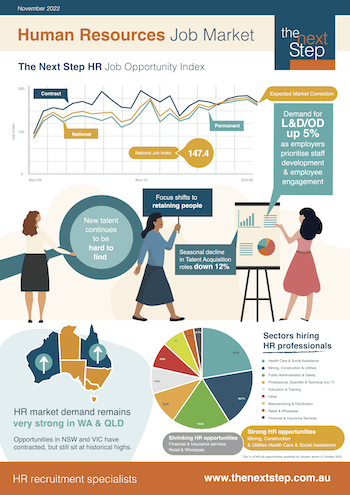

Human Resources Job Opportunities in Australia

2022 saw a slower than usual start to the period, probably due to the uncertainty created by the Omicron variant. Once momentum started to build, however, there was no stopping it and The Next Step HR Job Opportunity Index rose a net 18.1% in the 3 months to April. Current opportunities are sitting just shy of the record achieved in November last year. There is a good chance on current indicators that we will see a new record in the not-too-distant future.

The permanent market which is the backbone of Human Resources job opportunities continues to perform well and is 14.1% stronger than for the corresponding period in 2021. The job market shows no resemblance to the employment catastrophe that we were experiencing in April/May 2020. The pace and the strength of the recovery is breath taking. Only the most optimistic observer would have predicted such a stellar rise.

Strangely enough, employers and/or jobseekers are stubbornly focused on the Permanent market (which includes fixed term assignments). Contract assignments have increased over the past three months by almost 6% which is 1/3rd of the strength of the demand in the permanent market and they are line ball on this time last year. Sooner or later, organisations will need to look at more flexible solutions to their HR talent problems.

HR Job Opportunities by Region

The State HR Job Opportunity Index has seen strong growth across the larger markets but the standout performed was VIC. The southern state has enjoyed a remarkable turnaround in fortune after prolonged lockdowns, a welcome relief for HR professionals looking for new opportunity. Compared to the corresponding period last year, HR opportunities are up more than 31%. This compares to QLD which is up 15.1%, and NSW over 10%. The heat is on for talent in Victoria!

Whilst the other states have strong demand, results are more modest. Even though Mining & Resources as a sector is performing strongly nationally, the hangover of extended isolation in WA resulted in opportunities actually going backwards by 14% over the year. With their borders finally opening, we may see more opportunities being presented to the market. The question is - what is the appetite to relocate compared to years past?

Human Resources Job Opportunities by Job Title

Surprise, surprise. Talent Acquisition roles went nuts over the last 3 months. They are now back at the peak of the recovery in the market mid last year. As is normally the case, there was a seasonal downturn in jobs late last year but once the market hit March, the volume of TA opportunities went into overdrive.

Another area of strong demand is in Reward. For many companies seasonal periods of remuneration review are now over. This usually signals an uptick of movement in the Rewards space. With pressure on talent retention strategies also playing a role, demand for Reward professionals is acute. Job opportunities for Reward professionals are now at all time Index high, up 23% compared to the corresponding period last year.

Generalist HR Consultants are consistently in strong demand. Roles in this segment of the HR market are currently at an all-time high having increased 20% since 2021.

HR Job Opportunities by Industry

Once again, there are some clear winners in sector demand for HR professionals. Roles in the broad category of Professional, Scientific and Technical (incl IT) have reached an all-time record and show no sign of tapering off. Opportunities for HR professionals to support predominantly white-collar professional organisations is more than 50% stronger than for the same period in 2021.

Other sectors that are performing extremely well in regard to opportunities for HR professionals are Health Care and Mining and Resources. Neither of these outcomes are surprising and are in line with what is occurring in the broader employment market.

The sector that is dragging back the market for HR opportunities is the continued poor performance of Financial & Insurance Services. This once powerhouse of employment opportunities in HR has declined substantially over the past year. Given this sector traditionally paid well above other sectors (and still does), it can make it hard for HR professionals to transition to other areas of the market.

Download your copy of the latest HR Job Market news

Author : Craig Mason Date published : 26/05/2022