HR Job Opportunities Index: October

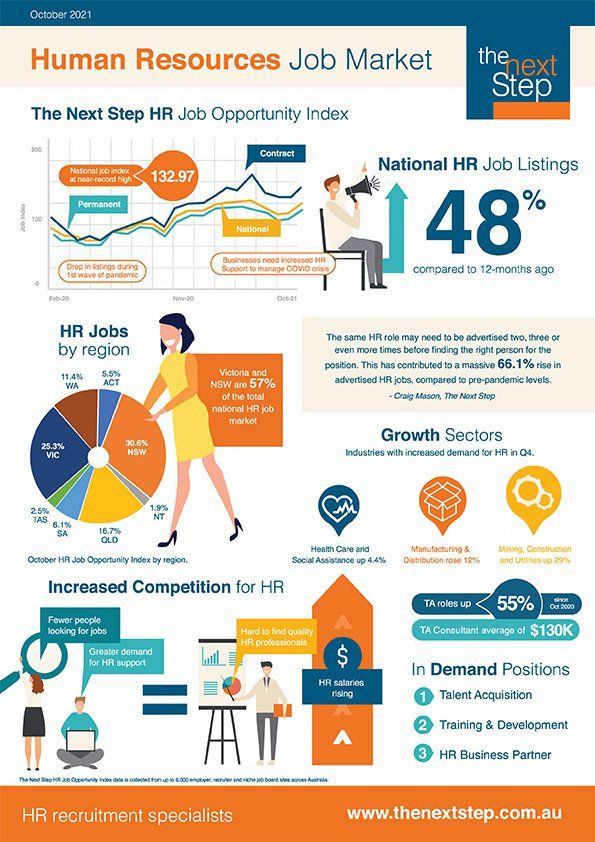

HR job opportunities have risen a massive 48% in the last 12-months, creating some enticing prospects for job-seekers. Employers, on the other-hand, are grappling with people-shortages.

In the October edition of The Next Step HR Job Opportunity Index we look at trends in the HR job market. Access the full report below, download a 1-page snapshot, or keep reading for more information.

Download the The Next Step HR Job Opportunities Index

The Next Step HR Job Opportunities Index

As we approach the closing weeks of 2021, the Reserve Bank along with all the other observers of the national employment market, are seeing strong increases in hiring intentions, particularly in Victoria and New South Wales. This is supported by anecdotal feedback from HR professionals across many sectors.

In its latest Statement on Monetary Policy, the RBA said forward-looking indicators of labour demand point to a strong recovery in the labour market over coming months well into the new year.

This increased demand, in the general employment market is being reflected in The Next Step HR Opportunity Index. HR Job Opportunities are rising as organisations grabble with crippling shortages of talent which looks set to continue in 2022

HR Job Opportunities Nationally

The Australian HR market has made a strong “post lockdown” recovery and The Next Step Job Opportunity Index rose 5.7% in the October quarter. The National Index now sits on 133.0 and is up almost 48% compared to the same period in 2020.

Interestingly the Index is also up 22% compared to the corresponding period 2-years ago pre-covid in 2019 underscoring the strength of the current national HR market.

Similar patterns of demand have been demonstrated throughout the last 12 months although contract opportunities peaked in demand at the start of the financial year. Historically contract demand tends to accelerate in tight markets as companies need to look at short term solutions for talent gaps and we saw the overall volume of contract roles increase from 17.6% to 22.3% of the market during this year.

Continued short falls of talent in most geographies and categories of HR would indicate demand remaining strong into the final weeks of 2021. It’s expected that this demand will pick up quickly in 2022 after a longer than normal holiday period recognising the expected pause over Christmas while leaders take a well-earned break.

HR Job Opportunities by State

The State HR Job Opportunities Index reinforces the National outcome but there are clearly some states that are over-performing. VIC is experiencing a significant bounce-back from the impacts of the pandemic. This is also supported with strong results in the other major east coast markets.

In VIC, the State HR Job Opportunities Index moved from 90.6 to its highest point in the Index’s history of 182.6. This is a 101.5% increase in demand year on year and an increase of 71% for the corresponding period pre covid in Oct 2019.

Whilst not at the same dramatic levels, the NSW and QLD markets are also manifestly more buoyant than 12-months ago and have experienced a 48.5% and 47% improvement respectively.

Whilst experiencing a strong market, the growth in NSW hasn’t been anything like VIC’s. NSW is only 2.5% better compared to the corresponding period in 2019 and so line ball on pre-COVID levels. On the other hand, QLD has fully recovered and has 16% more active than 2-years ago.

NSW and VIC represent 57% of all job opportunities nationally in the HR market and their combined strength is a major catalyst for the national market position.

HR Job Opportunities by Industry

There are some clear winners and losers in the HR Job Opportunities by Industry. The overwhelming dominate performer was Mining, Construction and Utilities. These heavier sectors saw a substantial 124.5% rise over 12-months and currently employs 15.6% of all HR professionals.

At the other end of the spectrum, the Finance and Insurance sector saw a reduction over the 12-months by 21.6%. This accords with anecdotal evidence as banks and insurance companies are in restructuring cycle resulting head count and costs reductions in HR. Traditionally job opportunities in the finance sector were more than 20% of the market, but currently they are reduced to just 13.7%.

Other substantial winners in the sector race over the past 12-months have been Professional, Scientific and Technical (inc. IT) up 71.4%, Health Care up 63.9% and Manufacturing up 55%.

HR Job Opportunities by Title

The past 12-months have seen strong growth in all role types, except for Remuneration roles. The overall number of opportunities in this space is only 1.5% of the market and demonstrates a very stable segment.

The stand-out performer was the increase in advertising of Talent Acquisition opportunities. They grew over the past 12-months by 55.2% and now make up 37% of all HR job opportunities. This marries with the intense pressure to acquire talent in sectors as diverse as Healthcare, IT, Mining, Construction as the post COVID economic recovery is creating significant demands and challenges.

Other role types that have seen strong growth in the opportunities include HR generalist and HSE roles which grew 52.1% and 51.8% respectively.

Click to download infographic

If you require specialist HR recruitment support or advice please reach out to your Next Step consultant.

Author: Craig Mason Date published : 17/11/2021